💳 Card & Miles Hack of the Week

We’re getting towards the end of 2025 and for some of us, there may be potential downgrades coming to our KrisFlyer status with Singapore Airlines.

Of course, staying a KrisFlyer Silver/Gold or PPS/PPS Solitaire member requires you to either have a racked up set amount of elite miles with SQ (Silver and Gold) or spent a certain amount on Business/First Class (PPS + PPS Solitaire) to earn PPS Value.

However, you can actually earn elite miles as a KrisFlyer Silver and Gold member by spending on the Kris+ app, KrisShop or Pelago to earn elite miles at a rate of 1 elite mile per S$1 spent.

Not many people are aware of this but if you are short of a few hundred elite miles then KrisFlyer Silver members can earn up to 5,000 elite miles by spending via one of these channels.

Meanwhile, KrisFlyer Gold members can earn up to 10,000 elite miles by spending on these various platforms during their membership year.

For PPS and PPS Solitaire members, the earn rate isn’t as good at just 1 PPS Value per S$3 spent but PPS members have a 2,500 PPS Value annual cap from their spend on these platforms while the equivalent cap for PPS Solitaire members is 5,000 PPS Value.

Of course, don’t spend massively for the sake of renewing it – if you’re clearly way off – but if you’re close to renewing at least you’re aware that these options exist without you have to take another SQ flight before your KrisFlyer status comes up for renewal.

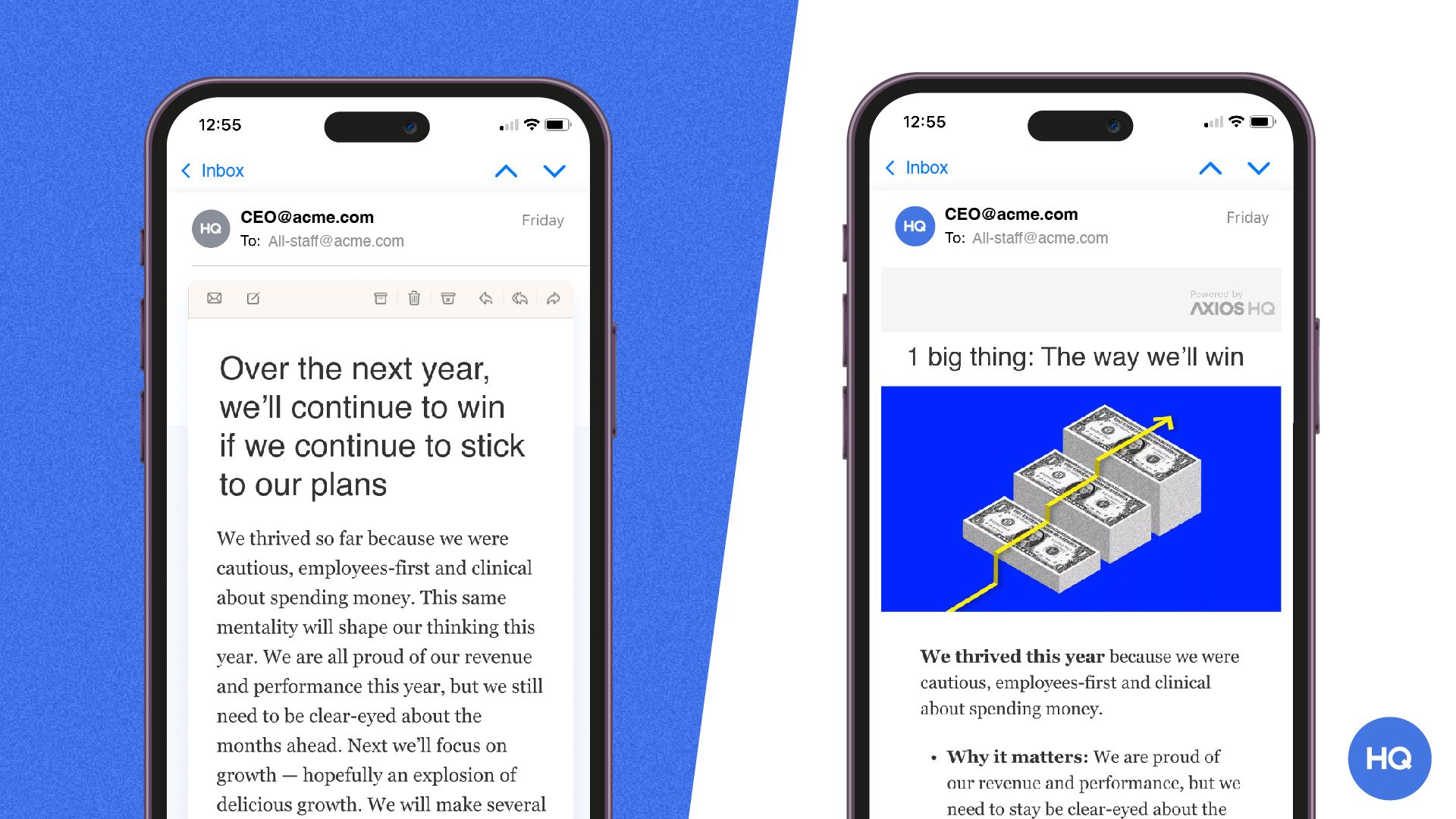

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

🎯 Personal Finance Quick Action

If you’re looking to spend money overseas during the December/Christmas holidays, then the cheapest options are typically a multi-currency card or cash.

However, getting our hands on foreign currency cash can be a bit of a pain if we want to get the best rate here in Singapore before we fly off.

That typically involves withdrawing money at an ATM and then going to exchange it at one of the many money changers at Raffles Place.

However, one money changer that allows you to skip the queues at Raffles and save time is ChangiFX.

Owned by Changi Airport Group (CAG), which also owns the Changi Recommend service, ChangiFX is an MAS-regulated money changer.

You can head to the ChangiFX website and pick from 19 different currencies before transferring Singapore Dollars via PayNow.

You then simply pick a time slot and date to pick up your foreign currency at any of the four departure terminals at Changi Airport (from the Changi Recommends booth).

As I outlined in one of my latest Instagram posts, this is a useful way to save time and spreads aren’t that wide – although they won’t be as cheap as Raffles.

The only caveats are that you have to exchange a minimum of S$300 and order at least one to two days in advance.

For those who want to skip queues and are willing to pay a bit more, in terms of the FX spread, then this certainly worth considering for some cash when you travel.

📈 Market Money Moves

Large Singapore utility Sembcorp Industries agreed to buy Australia-based Alinta Energy for a total of S$5.6 billion.

While the deal will be immediately earnings accretive to Sembcorp, Alinta’s coal-fired power plant will set Sembcorp back on its emission targets.

Tim’s Take: On the surface, this is a good deal for Sembcorp. Its argument that the deal for Alinta was driven by the potential for renewables expansion does make sense.

Alinta has over 10 gigawatts (GW) of power projects in development, most of which are in renewables.

However, the firm’s 1.2 GW coal-fired power plant does currently make up over one-third of its total 3.4 GW power-generating capacity.

That’s not going to look good for Sembcorp’s “Brown to Green” transition which aims to meaningfully grow its renewables portion as a percentage of overall net profit.

Regardless, the transaction is going to give Sembcorp access to an additional 1.1 million customers in electricity and gas retail markets in Australia.

It will also shift more of its net profit focus back towards developed markets – at a time when there are concerns around unproductive renewables assets in large emerging markets like China and India.

While the deal will be financed entirely by cash, it does raise questions about whether Sembcorp will be able to grow its dividend as fast as it has done in recent years.

Management did commit to maintaining its dividend per share at S$0.23 (same as FY2024) but the robust 50% year-on-year growth in its H1 2025 dividend might not be something shareholders will likely see for its full-year 2025 dividend.

📷 YouTube Deep Dive

Check out my latest YouTube video! Subscribe and follow along as I share a weekly tip on my Tim Talks Money channel.